Let’s discuss this BlueSkyMint.com review and take a closer look at what happens when a trading platform focuses on building investor confidence from the ground up. BlueSkyMint launched just a year ago with a clear goal: to make investing accessible while keeping security at the forefront.

What started as a small team with big ideas has grown into a community of traders who value openness and expert guidance. The platform serves both newcomers and experienced traders. But there’s a catch. The entry point starts at $10,000, which immediately sets expectations about who this platform serves..

Asset Diversity: Trading Options

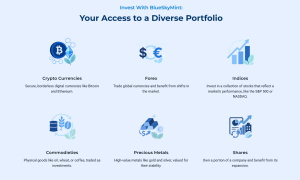

In this BlueSkyMint.com review, one of the first things to cover is the sheer variety of trading options. The platform gives users access to over 160 assets spread across six different categories.

Cryptocurrencies are available for those interested in digital assets. Bitcoin and Ethereum are the obvious ones, but the platform includes other options, too. Forex trading covers global currency pairs. The forex market moves fast, and having access to multiple pairs gives traders flexibility to respond to economic shifts.

Indices let users trade collections of stocks that represent entire markets. Think S&P 500 or NASDAQ. Commodities cover physical goods like oil, wheat, and coffee. Precious metals include gold and silver.

Shares give users exposure to individual companies. A key point in this BlueSkyMint.com review is that all these asset classes trade as CFDs, which adds leverage to every position.

Account Tiers Breakdown

The platform structures everything around six account tiers. Each one comes with different features, support levels, and minimum deposits.

Bronze tier starts at $10,000. Users get access to the Trading Academy, weekly market reviews, an assigned account manager, and weekly portfolio reports. Leverage caps at 1:10 for this entry level.

Silver tier requires $25,000. Everything from Bronze carries over, plus users get a personal portfolio manager and weekly analyst sessions. Leverage stays at 1:10.

Gold tier jumps to $50,000. This is where things get more interesting. Leverage increases to 1:50. Users get daily analyst sessions instead of weekly ones, live webinars every week, custom trader education, daily market signals, access to VIP events, and a 25% swap discount.

Platinum tier costs $100,000 to enter. All Gold features remain, with additions like monthly accountant sessions, 24/7 account monitoring, and annual summaries.

Diamond tier starts at $250,000. The feature set matches Platinum exactly. The main difference is the commitment level and potential relationship with the platform.

VIP tier requires $500,000. It must be noted in this BlueSkyMint.com review that this top tier gets completely customized treatment. Leverage becomes tailor-made based on individual needs. Spreads start from 0.001 pips. There are no commissions. Trading is swap-free.

Exclusive VIP Features

The VIP level opens doors that lower tiers can’t access. Users get to trade ETFs, which aren’t available to anyone else on the platform. They also get access to IPOs and ICOs, letting them get in early on new investment opportunities.

Trade sizes range from 0.01 up to 100 lots. The platform uses STP and market execution with no requotes. Users can trade 100 currency pairs and over 600 CFD pairs. The stop-out level sits at 20%, giving positions more room to breathe during volatility.

Educational Resources

Another point to highlight in this BlueSkyMint.com review is how education scales with account level. Everyone gets access to the Trading Academy from day one. This covers the basics for people still learning how markets work.

Custom trader education starts at the Gold level. This means personalized learning based on individual trading style and goals. It’s not generic content anymore. It’s specific guidance.

Live webinars run weekly for Gold accounts and higher. These sessions cover current market conditions, strategies, and answer questions in real time. VIP events add another layer for premium accounts, bringing together serious investors for networking and advanced education.

Personal Support Features

Every account gets an assigned account manager. This person becomes the main point of contact for questions, issues, or guidance. Having one consistent person to work with makes communication smoother.

Personal portfolio managers start at Silver level. These specialists help users think through position sizing, risk management, and overall portfolio construction. They provide professional input without making decisions for users.

Daily analyst sessions begin at the Gold tier. A few more insights in this BlueSkyMint.com review include how these sessions give users a daily check-in with someone who watches markets full-time. Analysts point out opportunities, risks, and important events to watch.

Accountant sessions start at the Platinum level and run monthly. These help users think through tax implications and financial planning around their trading activity. Account monitoring runs 24/7 for Platinum and Diamond tiers.

Platform Transparency

As can be seen in this BlueSkyMint.com review, BlueSkyMint puts significant emphasis on operating with openness. The company states clearly what features each tier includes. Pricing for different account levels is straightforward. There aren’t hidden fees that surprise users later.

The platform provides clear information about how CFDs work, what leverage does, and what risks come with different trading strategies. They don’t hide the fact that most retail investor accounts lose money trading CFDs. This honesty extends to how they communicate with users.

Special Perks and Events

VIP events create networking opportunities for Gold tier and above. These aren’t just social gatherings. They have chances to connect with other serious traders and share strategies.

Annual summaries come with Platinum and Diamond accounts. These comprehensive reports break down trading activity, performance, and patterns over the full year. They help users see bigger-picture trends in their own behavior.

The 25% swap discount for Gold and higher tiers reduces costs for positions held overnight. For traders who don’t close everything by the end of the day, this adds up over time.

The Company Story

BlueSkyMint launched a year ago with a focused mission. The founding team wanted to change how people invest by building a platform that valued knowledge and accessibility. It’s worth emphasizing in this BlueSkyMint.com review that a one-year track record is relatively new in the trading platform space.

The company’s vision centers on driving financial growth through secure, transparent, and accessible investing. Their mission focuses on giving every investor a world-class trading experience through simple platform access, powerful tools, and honest practices.

FAQs

What is the minimum deposit required?

The Bronze tier sets the entry point at $10,000. This is the lowest amount needed to open an account and start trading on the platform.

Can I trade on mobile devices?

Yes. The platform works through web browsers, so any device with internet access can be used for trading. Mobile phones and tablets work just as well as desktop computers.

What kind of support can I expect?

All users get 24/7 support access and an assigned account manager. Higher tiers add personal portfolio managers, daily analyst sessions, and 24/7 account monitoring depending on the level.

How many assets can I trade?

The platform offers access to over 160 assets across six categories: cryptocurrencies, forex, indices, commodities, precious metals, and shares.

Are there educational resources for beginners?

Yes. Every account includes Trading Academy access. Higher tiers get custom trader education, live webinars, and analyst sessions to support continued learning.

What makes the VIP account different?

VIP accounts get completely customized features, including tailor-made leverage, access to ETFs, IPOs, and ICOs, swap-free trading, and spreads starting from 0.001 pips. It’s built around individual needs rather than standard features.

Closing Thoughts

This BlueSkyMint.com review concludes with an honest assessment of what the platform offers. The $10,000 entry point immediately narrows the audience to serious investors.

But for those who meet that threshold, the platform delivers institutional-grade security, comprehensive educational support, and a tier system that grows with user experience. The one-year track record means the platform is still proving itself, but the structure and features suggest a serious approach to building long-term investor relationships.